The concept of asset allocation models isn’t new by any means, but how it is delivered to RIAs, Consultants, and other Institutional gatekeepers has never carried as much importance as it does today. Fee compression and commoditization of investment products over the last decade are threatening already slim margins in asset management. There are two key components asset managers must get right.

- The gatekeepers of the Institutional assets need to maintain a visible point of adding value to their client; The easiest way to provide a visible value add and least affect the performance of the end product is selection of the specific assets used in the model.

- The second place that asset managers must shift their delivery method is leveraging technology that allows this sophisticated flexibility at very low cost to support each iteration.

- The combination of driving more assets into the models through greater appeal to Institutional asset gatekeepers at very low cost to support the next custom model account sold will drive gross margins and effectively combat fee compressions hit to the bottom line.

The core value proposition of models is two-fold: with better alpha, less beta. Most research out there suggests that about 90% of the variability of returns of a typical mutual fund across time can be explained by asset allocation. Models take that concept a step further simply by their nature of being a strategically selected group of funds.

It’s clear that advisor appetite for models is growing. One industry study of 500 advisors cited in Ignites said 85% are now using models in some shape or form. The models can be created either in-house or by a third party, like an asset manager or consultant.

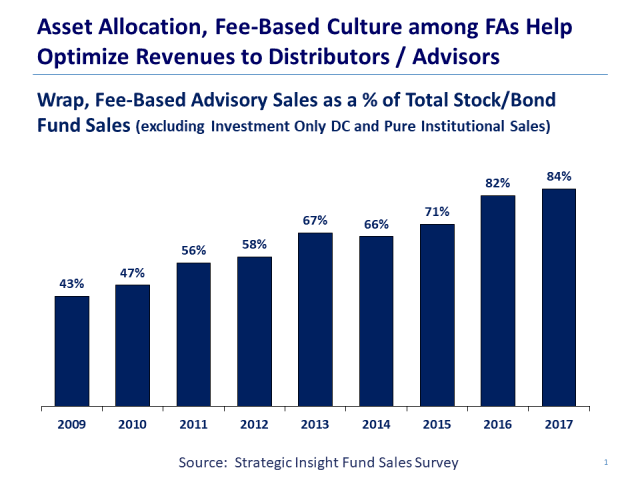

Advisors are not only using models, but they represent a growing proportion of new total fund sales and have been rising for more than a decade now (see the chart below).

Chart by Avi Nachmany

If the core growth opportunity in investment management is now design of model portfolios, how does an asset manager maximize this business opportunity?.

The key is using the right technology to scale model sales and ultimately drive the cost to support the next sale to zero. In fact, the evolutionary point facing the asset management industry is similar to software’s move from bespoke installed software to the cloud-based SaaS software business model, something we know very well at Delta Data. Legacy models are tailored to a historical mindset of value and are delivered in a non-scalable and inflexible bespoke model. The new model is to design a single instance of the software for the flexibility required and once you have the product created and the implementation teams in place, your additional cost to sell that product over time essentially becomes the cost of your business development team.

Evolution of models

First, we should take a step back to understand how we got here. If you think about it, models initially got their start in mutual funds (as they were a collection of securities). In the years to follow, we saw the same philosophy applied to more bespoke retirement products such as the Target Date Fund (TDF) in the 1990s, and later with the Separately Managed Account (SMA).

Several years ago, Robo advisors burst onto the scene, bringing the idea of model portfolios into the mainstream with direct to consumer, turnkey investing. And while most incumbents now offer their own version of a digital advisor platform, models are starting to pop up in institutional distribution channels as well.

For example, we’re now seeing a proliferation of models in use on dealer managed account platforms. Morningstar rolled out model marketplace in May, and TD Ameritrade launched a platform last year, allowing advisors clearing through TD Ameritrade Institutional to access third-party models. Our firm is moving into production technical capabilities with several Record-Keeping clients the ability to deliver customizable ERISA based products based on white-labeled models which are finished out with specific funds and underlying assets selected by the RIA or Consultant who has the relationship with the Sponsor.

Opportunity for asset managers: advisors want to work with asset managers on models

A Cerulli Associates survey of 1,000 advisors cited in Ignites states that there is $6.8 trillion in potential assets for asset managers to tackle.

Asset managers are in the best position to capitalize on this trend. The opportunity is for asset managers to take an active role in constructing the models for these platforms directly. And they should – advisors are coming to them for their expertise, so this makes perfect sense.

Technology underpinning models is improving to the point where asset managers can more seamlessly create, launch, and manage across multiple distribution platforms. This allows asset managers to realign to improve alpha for the client and also helps asset managers stay profitable as they scale. It also allows them to operate with lower fees to their client’s benefit.

Conclusion

From all of the indicators, asset allocation models are primed to continue gaining prominence in investment management. Asset managers, therefore, are presented with a huge opportunity to strengthen distribution channels and grow assets by taking an active role in the creation of models that allow advisors to add value to their clients. Scalability of this customizable product is now the name of the game – making sure that your firm has the right processes in place, including the proper technology infrastructure, is how you win. It’s crucial to recognize this shift in the industry, move off of your legacy position and delivery channel before you’re left behind.